With life insurance, what is the difference between stepped and level premiums?

When you take out life insurance, there are generally two ways you can pay your premiums.

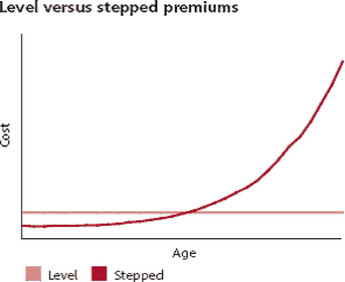

You can opt for a stepped premium that increases every year with your age. Or you can choose a level premium that generally doesn’t change over time.

While stepped premiums are usually lower in the earlier years, level premiums can become more affordable – often at the stage in life when you need the cover most. The savings in the later years can also make up for the additional cost in the earlier years, saving you money over the life of the policy.

The best option for you will depend primarily on how long you continue the insurance cover.

When deciding which option to choose, remember you could need insurance to cover your debts and income for 30 years or longer.

You should also keep in mind that the earlier you lock-in the level premium, the greater the potential long-term savings. This is because level premiums are based on your age when the policy commences and are generally lower if your take out the cover at a younger age.

Another issue to consider is that it can be easier to budget for a level premium than a stepped premium which generally increases each year.

To find out which option suits you best, we recommend you speak to us.